Update Your PAN Card Information The Easy Way

The Ultimate Guide to Correcting Your PAN Card Online: Quick, Easy, and Hassle-Free

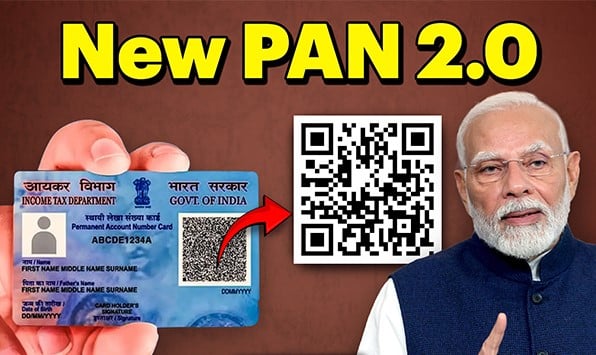

Your PAN card is more than just a document; it’s a gateway to essential financial services in India. From filing taxes to opening a bank account, this card is crucial. But what happens when there’s an error in your PAN details? Or you’ve relocated and need to update your address? Don’t worry correcting your PAN card is easier than you think!

In this blog, we’ll guide you on the importance of maintaining accurate PAN card details, the documents you’ll need for updates, and the timeline involved. Let’s dive in!

Why It’s Important to Update Your PAN Card

Your PAN card isn’t just a tax document it’s also a valid ID proof for various purposes, including:

- Linking your bank account for financial transactions.

- Verification for government services.

- Serving as proof of identity and address.

Errors or outdated information can lead to delays in important transactions. So, if you notice incorrect details, take action promptly to avoid complications.

What Can You Update on a PAN Card?

You can make corrections or updates to the following details on your PAN card:

- Name or Father’s Name

- Date of Birth

- Photograph or Signature

- Gender

- Address

- Aadhaar Number

👉 Note: It’s essential to keep your PAN details accurate, as discrepancies may lead to penalties.

Documents Needed for PAN Card Corrections

The required documents depend on the type of update:

For Personal Details

- Aadhaar Card

- Passport

- Voter ID

- Birth Certificate

For Address Updates

- Utility bills (electricity, water, gas, or landline)

- Bank statement or passbook

- Driving license

For Non-Individuals

- Certificate of Registration for companies, partnerships, or trusts.

How Long Does It Take?

Once your application is submitted, you can expect the updated PAN card to arrive within 15-30 days. For e-PAN cards, the process may be even faster!

Why Correcting PAN Card Errors is Crucial

PAN card errors can cause issues, such as:

- Delays in tax refunds.

- Incorrect filing of income tax returns.

- Discrepancies in financial records.

By addressing errors quickly, you’ll ensure smooth financial transactions and compliance with tax regulations.

-

15 Best AI Tools for Developers in 2025 (Free & Paid)

15 Best AI Tools for Developers in 2025 (Free & Paid) The rise of artificial intelligence is transforming how developers write, debug, and optimize code. From automating repetitive tasks to predicting errors before they happen, AI tools are becoming indispensable for coders in 2025. Whether you’re a Python pro, a JavaScript enthusiast, or a full-stack…

-

Easy Ways to Prepare for AWS Questions in 2025

Mostly Asked AWS Interview Questions in 2025 Impact-Site-Verification: c45724be-8409-48bd-b93e-8026e81dc85aAmazon Web Services (AWS) has consistently remained at the forefront of cloud computing. With organizations migrating their infrastructures to the cloud, AWS-certified professionals are in high demand. Cracking an AWS interview in 2025 demands not just conceptual clarity but also hands-on familiarity with AWS services. In this…

FAQs

1. How do I track my PAN card correction status?

Visit the NSDL or UTIITSL portal and enter your acknowledgment number under the “Track PAN” section.

2. Can I update my PAN card details offline?

Yes, you can visit a PAN service center to submit your application and required documents physically.

3. Is an e-PAN card accepted everywhere?

Yes, the electronic PAN card (e-PAN) is valid for most financial and identification purposes.

Conclusion

Maintaining accurate PAN card details is essential for seamless financial operations and tax compliance. With straightforward update processes and quicker timelines for corrections, there’s no reason to delay!

Stay updated and stress-free with your PAN card corrections!

The design of Blog is absolutely stunning. The minimalist aesthetic makes it easy to read, with a good balance of text, images, and white space. Navigation is intuitive, and I love how the categories are clearly marked, so you can easily find posts related to your specific interests. The font size and color contrast are also well chosen, ensuring that the content is comfortable to read for extended periods.

One of my favorite features is the search bar at the top of every page, making it easy to look up specific content quickly. However, I did notice that some pages take a bit longer to load, especially when there are lots of images. A more streamlined approach to image optimization might improve the loading times.

Overall, the blog’s design is clean, modern, and user-friendly. It’s a pleasure to read and explore, but a little attention to speed would make it even better.