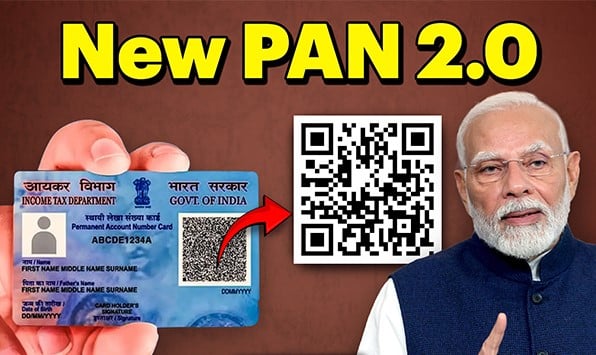

Update Your PAN Card Information The Easy Way

The Ultimate Guide to Correcting Your PAN Card Online: Quick, Easy, and Hassle-Free

Your PAN card is more than just a document; it’s a gateway to essential financial services in India. From filing taxes to opening a bank account, this card is crucial. But what happens when there’s an error in your PAN details? Or you’ve relocated and need to update your address? Don’t worry correcting your PAN card is easier than you think!

In this blog, we’ll guide you on the importance of maintaining accurate PAN card details, the documents you’ll need for updates, and the timeline involved. Let’s dive in!

Why It’s Important to Update Your PAN Card

Your PAN card isn’t just a tax document it’s also a valid ID proof for various purposes, including:

- Linking your bank account for financial transactions.

- Verification for government services.

- Serving as proof of identity and address.

Errors or outdated information can lead to delays in important transactions. So, if you notice incorrect details, take action promptly to avoid complications.

What Can You Update on a PAN Card?

You can make corrections or updates to the following details on your PAN card:

- Name or Father’s Name

- Date of Birth

- Photograph or Signature

- Gender

- Address

- Aadhaar Number

👉 Note: It’s essential to keep your PAN details accurate, as discrepancies may lead to penalties.

Documents Needed for PAN Card Corrections

The required documents depend on the type of update:

For Personal Details

- Aadhaar Card

- Passport

- Voter ID

- Birth Certificate

For Address Updates

- Utility bills (electricity, water, gas, or landline)

- Bank statement or passbook

- Driving license

For Non-Individuals

- Certificate of Registration for companies, partnerships, or trusts.

How Long Does It Take?

Once your application is submitted, you can expect the updated PAN card to arrive within 15-30 days. For e-PAN cards, the process may be even faster!

Why Correcting PAN Card Errors is Crucial

PAN card errors can cause issues, such as:

- Delays in tax refunds.

- Incorrect filing of income tax returns.

- Discrepancies in financial records.

By addressing errors quickly, you’ll ensure smooth financial transactions and compliance with tax regulations.

-

BBW Dating With Woman | Totally Free BBW Adult Dating Sites | Meet BBW Singles

What makes BBW online dating your large fantasy? We know BBW women can be the embodiment of elegant human anatomy and mild heart. They’ve been lovely, comfortable and filled with existence. Size is not important if they have self-confidence and internal love to on their own together with world around them. They have been genuinely…

-

Get started now and find your perfect match

Get started now and find your perfect match Dating apps like tinder and grindr are superb for fulfilling brand new individuals, but imagine if you are looking for a long-term relationship? if you’re wanting a daddy chat gay relationship, you should consider utilizing a dating application specifically made for that purpose. there are a number…

-

Most Useful Gay Hookup Websites – Brand-new Knowledge About Nice Men

Most Useful discreet gay hookup website – Brand-new Knowledge About Nice Boys ???? Best Hookup websites for LGBT ???? I discovered one of the best website and a quantity of other people to dicuss quickly. I would say that there is a lot more ineffective traditional that about webpage. Very, i came across myself personally…

FAQs

1. How do I track my PAN card correction status?

Visit the NSDL or UTIITSL portal and enter your acknowledgment number under the “Track PAN” section.

2. Can I update my PAN card details offline?

Yes, you can visit a PAN service center to submit your application and required documents physically.

3. Is an e-PAN card accepted everywhere?

Yes, the electronic PAN card (e-PAN) is valid for most financial and identification purposes.

Conclusion

Maintaining accurate PAN card details is essential for seamless financial operations and tax compliance. With straightforward update processes and quicker timelines for corrections, there’s no reason to delay!

Stay updated and stress-free with your PAN card corrections!