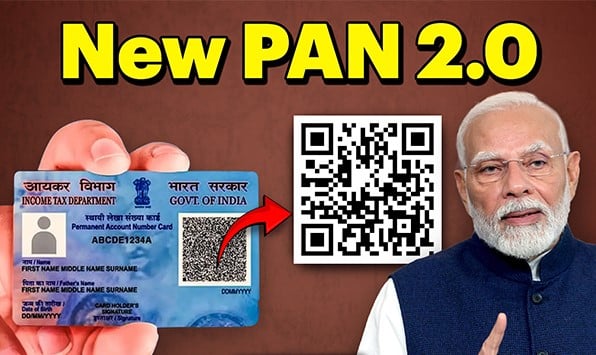

What You Need to Know About PAN Card 2.0 in India

PAN Card 2.0: A New Era of Digital Identity in India

For decades, the Permanent Account Number (PAN) card has been a cornerstone of financial transactions in India. It’s more than just a tax identification tool—it connects individuals and businesses to the nation’s economy. Now, with the rollout of PAN Card 2.0, India is stepping into the future. This upgraded version isn’t just about a new design; it’s about redefining how we manage financial and personal identity in the digital age.

If you’re wondering what’s new, how it benefits you, and what to expect, let’s break it all down in a simple and relatable way.

What is PAN Card 2.0?

PAN Card 2.0 is an enhanced version of the existing PAN card, designed to fit seamlessly into India’s growing digital ecosystem. It comes with additional features aimed at making it more secure, user-friendly, and adaptable to modern needs. Think of it as your regular PAN card, but smarter and more versatile.

Key Features of PAN Card 2.0

Here’s what makes PAN Card 2.0 a game-changer:

- QR Code Integration:

PAN Card 2.0 now includes a scannable QR code that contains all your key details, such as your name, date of birth, and PAN number. This ensures quick verification during financial transactions and reduces the risk of fraud. - Digital Compatibility:

Unlike its predecessor, this card is fully optimized for digital use. You can easily link it to apps, e-wallets, and online banking platforms. No more fumbling with physical copies! - Enhanced Security:

With advanced encryption and anti-counterfeiting measures, PAN Card 2.0 addresses one of the biggest concerns with the original version—identity theft. - E-PAN Integration:

PAN Card 2.0 aligns seamlessly with the already existing e-PAN system, making it easier for individuals to store, access, and use their PAN digitally.

Why PAN Card 2.0 Matters

If you’re someone who dreads paperwork or worries about the security of your financial data, PAN Card 2.0 is a breath of fresh air. Here’s why it’s important:

- Faster Verification: Imagine you’re at the bank to open an account, and instead of filling out long forms, the executive scans your PAN card’s QR code to fetch your details. It saves time for everyone.

- Reduced Fraud: The added security features make it significantly harder for fraudsters to create fake PAN cards or misuse your identity.

- Convenience: From loan applications to mutual fund investments, PAN Card 2.0 makes life easier by integrating seamlessly into online platforms.

A Personal Story

Let me share a quick example. My uncle, Rajesh, runs a small business and often needs to provide his PAN card for tax-related work. Last month, he was finalizing a business loan when the bank told him about the new PAN Card 2.0. Initially skeptical, he upgraded to it and was amazed at how quickly his loan process sped up. The QR code allowed the bank to verify his identity instantly, cutting down hours of paperwork.

Rajesh now carries his digital PAN on his phone and rarely feels the need to pull out the physical card. “It’s like having my financial identity in my pocket, ready to go,” he says.

How to Upgrade to PAN Card 2.0

If you’re wondering how to switch to this upgraded version, don’t worry—it’s a straightforward process.

- Visit the Official Portal:

Head to the Income Tax Department’s official website or the NSDL portal. - Fill Out the Application:

Select the “Upgrade to PAN Card 2.0” option and complete the online form. - Pay the Fee:

A nominal fee is required for the upgrade, which can be paid digitally. - Verification:

Once your application is submitted, your details will be verified, and the upgraded card will be issued. - Receive Your Card:

You’ll get both a physical card and a digital version (e-PAN) that you can download instantly.

Who Should Upgrade?

While PAN Card 2.0 is available for everyone, here are the people who might benefit the most:

- Frequent Travelers: No need to carry the physical card—just use the e-PAN on your phone.

- Business Owners: Speed up transactions and document verification.

- Young Professionals: Start your financial journey with a secure, digital-first identity.

Practical Tips for Using PAN Card 2.0

To make the most of PAN Card 2.0, keep these tips in mind:

- Store Your Digital PAN Safely: Avoid sharing your e-PAN on unsecured platforms.

- Keep the QR Code Intact: The QR code is crucial for quick verification, so ensure it doesn’t get damaged.

- Update Your Details Promptly: If you change your address or phone number, update it on your PAN to keep everything synced.

-

The Benefits of Using a TAN Card for Easy Financial Tracking

Spread the KnowledgeTAN Card: Your Hassle-Free Solution to Tracking Financial Transactions In today’s digital age, managing and securing financial transactions has become an essential task for both individuals and businesses. The rise of online payments and e-commerce has not only made transactions faster but also more vulnerable to potential security threats. A TAN card (Transaction…

-

How to Show Your Finance Experience on a Resume

Spread the KnowledgeFinance Resume Examples and Guidance Crafting a compelling resume for a finance role is crucial to standing out in a competitive field. Below is an organized overview of finance resume examples, including tailored guidance for specific positions and experience levels. These examples are written by certified resume experts and are perfect for gaining…

-

EPF Money: Is it now possible to withdraw it from any ATMS ?

Spread the KnowledgeAccess Your EPF Savings with Ease: Get Ready for PF Withdrawal at ATMs As a diligent EPF account holder, you’ll soon be able to access your hard-earned savings with unprecedented convenience. From January 2025, you’ll have the power to Understanding UPI Payment Frauds in India: A Wake-Up Call funds directly from ATMs, making…

Final Thoughts

PAN Card 2.0 isn’t just a piece of plastic; it’s a step forward in simplifying how we manage our financial identity. Whether you’re a student filing your first tax return, a business owner managing accounts, or a salaried professional investing in mutual funds, this new version offers unmatched ease and security.

The future of India’s financial ecosystem is digital, and PAN Card 2.0 is a crucial part of that journey. If you haven’t upgraded yet, now’s the perfect time to do so. After all, staying updated isn’t just about keeping up with trends—it’s about making life easier and more secure.

So, are you ready to embrace PAN Card 2.0? Let us know your thoughts or experiences in the comments below!